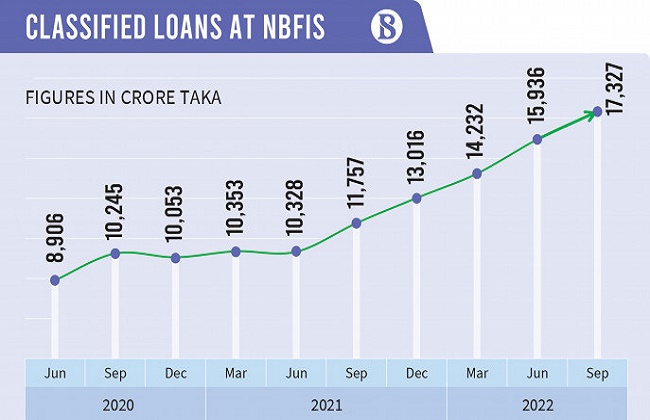

The defaulted loans of None Bank Financial Institutions (NBFIs) increased to Tk 17,855 crore or 25 percent at the end of March this year. Currently, the default rate of financial institutions is almost three times higher than that of the banking sector, BB sources said.

According to the data of Bangladesh Bank, at the end of March, the banks’ defaulted loans were 8.80 percent of their disbursement as against the default loans of NBFIs of 25 percent.

BB data showed that, as of March 31 of this year, the total debt of NBFIs was Tk 71,265 crore, which was Tk 70,436 crore on December 31. This means that the debt has increased by Tk 829 crore in three months. During this period, defaulted loans increased by Tk 1033 crore.

According to the BB report, at the end of March, the total default loans of NBFIs stood at Tk 17,855 crore, which was Tk16,821 crore at the end of December last year. At the end of March 2022, total default loans were Tk 14,232 crore, which means the defaulted loans have increased by Tk 3,622 crore in one year.

Among the 35 NBFIs of the country, the default rate of 16 institutions is 30 to 99 percent.

According to the BB data, People’s Leasing has the most default loans at the end of March 2023. The default rate of the company is 99.62 percent, followed by BIFC with 96.90 percent and Fareast Finance with 94.25 percent.

Default loans of other NBFIs are International Leasing 90.93 percent, Fast Finance 89.90 percent, FAS Finance89.63 percent, Union Capital 53.24 percent, IIDFC 50.20 percent, Premier Leasing 48.88 percent, Uttara Finance 45.75 percent, GSP Finance 42.70 percent, Bay Leasing 41.24 percent, National Finance 38.33 percent, Phoenix Finance 35.83 percent, Meridian Finance 33.83 percent and Aviva Finance 30.02 percent.

Kayser Hamid, Managing Director of BD Finance, told The News Times that the condition of some financial institutions have been critical.

“There was moratorium on repayment for three consecutive years for financial institutions. Removal of the facility led to sudden increase in default loans. Efforts are being made to overcome the situation,” he added.