In recent years, public-private partnerships (PPPs) have spread rapidly. While usually profitable for the private partners, PPPs have generally not served the longer-term public interest. PPPs as miracle all-purpose solution As Eurodad has shown, PPP financing has grown in recent years, particularly in the Sustainable Development Goals (SDGs) funding discourses. Adopted by

Author: Jomo Kwame Sundaram, IPS

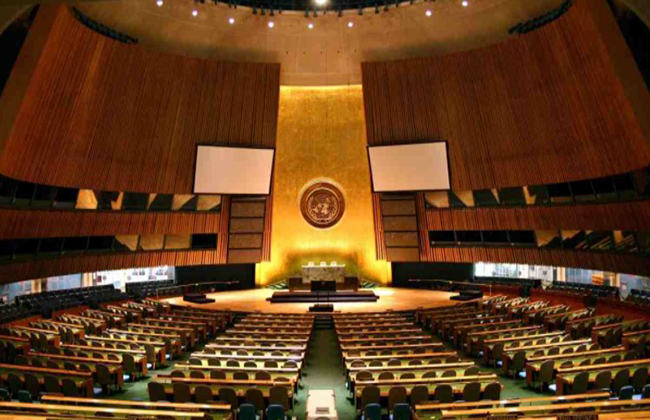

Finally, a real chance for international tax cooperation

After decades of resistance by rich nations, African governments successfully pushed for the United Nations to lead on international tax cooperation. All developing countries and fair-minded governments must rally behind this initiative. UN leadership The official UN Secretary-General’s Report (SGR) was mandated by a UN General Assembly resolution, unusually adopted by consensus

UN financing appeal last hope for SDGs and climate?

The United Nations Secretary-General’s Dialogue on Financing for Development on 20 September may well be the world’s last chance to save the Sustainable Development Goals (SDGs) and curb global warming in time. The UN and international finance Many features of the international financial system – including multilateral arrangements developed over many decades

UN must reclaim multilateral governance from pretenders

International governance arrangements are in trouble. Condemned as ‘dysfunctional’ by some, multilateral agreements have been discarded or ignored by the powerful except when useful to protect their interests or provide legitimacy. Economic multilateralism under siege Undoubtedly, many multilateral arrangements have become less appropriate. At their heart is the United Nations (UN) system,

Mining revenues undermined

The primary commodity price boom early this century has often been attributed to a commodity ‘super-cycle’, i.e., a price upsurge greater than what might be expected in ‘normal’ booms. This was largely due to some minerals as most agricultural commodity price increases were more modest. This minerals boom improved many developing

Exchange rate movements due to interest rates, speculation, not fundamentals

Currency values and foreign exchange rates change for many reasons, largely following market perceptions, regardless of fundamentals. Market speculation has worsened volatility, instability and fragility in most economies, especially of small, open, developing countries. US Fed pushing up interest rates For no analytical rhyme or reason, US Federal Reserve Bank (Fed) chairman

US policies slowing world economy

Few policymakers ever claim credit for causing stagnation and recessions. Yet, they do so all the time, justifying their actions by some supposedly higher purpose. Now, that higher purpose is checking inflation as if it is the worst option for people today. Many supposed economists make up tall tales that inflation

Needed global financial reforms foregone yet again

Calls for more government regulation and intervention are common during crises. But once the crises subside, pressures to reform quickly evaporate and the government is told to withdraw. New financial fads and opportunities are then touted, instead of long needed reforms. Global financial crisis The 2007-2009 global financial crisis (GFC) began in

Better late than never, but act now

The world should now be more aware of likely COVID-19 devastation unless urgently checked. Last week, the World Health Organization (WHO) announced an US$8 billion plan to quickly vaccinate many more people to expedite ending the pandemic. New WHO plan Perhaps frustrated after being ignored by rich country governments and major vaccine