Bangladesh Bank Governor Dr Ahsan H Mansur said on Sunday that Bangladesh has made significant progress in the development of its financial sector though there have been numerous shortcomings that necessitate a thorough self-assessment. "The banking sector of Bangladesh has progressed a lot. There is no doubt about it. On the

Business

BRAC Bank wins Remittance Award

The Ministry of Expatriates’ Welfare & Overseas Employment has awarded BRAC Bank the prestigious Remittance Award. This recognition from the government of Bangladesh demonstrates BRAC Bank's strong commitment to bolstering the economy by simplifying remittance processes for wage earners across the world. The ministry conferred the accolade to BRAC Bank

50-Day Replacement Guarantee for Used Laptops

For the first time in Bangladesh, Device Mama, a renowned seller of used laptops, is offering a 50-day replacement guarantee along with five years of free servicing for used laptops. If any hardware-related issue arises within 50 days of purchase, customers can replace the laptop with another one. Beyond this

Dhaka Regency to hold Christmas celebration

In the Festive season who hasn’t dreamt of staying in a hotel for Christmas? If you think of the best luxury country hotels for Christmas, you can almost picture the festive scene; great food, beautiful decorations, chromatic & splendid atmosphere of Dhaka Regency Hotel & Resort. Dhaka Regency Hotel & Resort

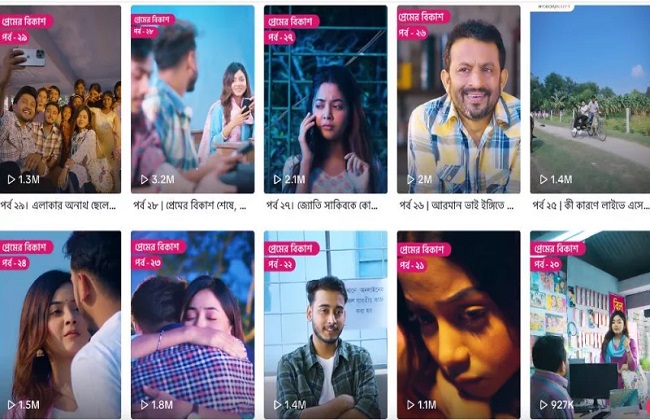

‘Premer bKash’ viewed over 73 million times on TikTok

Over 8 million TikTok users have viewed the entertaining and awareness-building short-length web series ‘Premer bKash’, aired on bKash's community channel 'Amar bKash', more than 73 million times. The series, consisting of 31 episodes of two to three minutes each, revolves around the themes of love, affection, separation, conflict, and friendship,

EBL launches freelancer ambassador program

To empower and inspire Bangladesh's growing freelancing community, Eastern Bank PLC. (EBL) has launched an innovative ‘EBL Freelancer Ambassador Program’. The initiative is expected to promote financial inclusion and to contribute to the nation's economic progress. Md. Zakir Hossain Chowdhury, Deputy Governor of Bangladesh Bank, Mitchel Lee, Chargé d'affaires of

UBL holds Shari’ah supervisory committee meeting

43rd (1st of the newly formed committee) meeting of the Shari'ah Supervisory Committee of Union Bank PLC (UBL) was held at the bank’s head office under the chairmanship of Dr. Abu Noman Mohammed Rafiqur Rahman Madani. The meeting was conducted by the member secretary of the committee Professor Dr. Hafiz

SEB signs MoU with D Money

Recently Southeast Bank PLC (SEB) signed a Memorandum of Understanding (MoU) with D Money Bangladesh Limited at the Bank's Head Office in Dhaka. This partnership aims to facilitate push-pull service, fund disbursement services and secure Payment Gateway Service, aligning with the evolving digital payment ecosystem in Bangladesh. Nuruddin Md. Sadeque

realme C75 launched

realme has officially launched the realme C75 in Bangladesh on December 19. Boasting the segment’s first IP69 rating, the device stands out as the Extreme Waterproof and Ultimate Durability Champion. On December 19, realme outlets across the country saw a great response from customers. The phone is now available for

Chinese company to invest US$ 28.92 million in BEPZA Economic Zone

Ding Yu (BD) Enterprise Ltd., a Chinese company, is set to invest US$ 28.92 million in BEPZA Economic Zone (BEPZA EZ) to establish a garments manufacturing industry. The Bangladesh Export Processing Zones Authority (BEPZA) signed an agreement with the company on December 23, 2024, at the BEPZA Complex in Dhaka. BEPZA Executive