More private commercial banks (PCBs) bagged substantial operating profits in the just-concluded calendar year as widening interest-rate spread alongside private-sector-credit growth paid off.

The FE collected unaudited operating-profit figures of 11 more banks, out of a total of 42, including nine new PCBs, until going to press on Saturday.

Of them, the operating profits of nine PCBs increased in 2021 and two others witnessed fall, according to available information.

Of those banks, Southeast Bank Ltd made an operating profit of Tk 10.16 billion in the bygone year against Tk 8.15 billion of the previous year, while Bank Asia Ltd earned Tk 10.02 billion, up from Tk 7.23 billion in 2020.

Mercantile Bank Ltd posted an operating profit worth Tk 7.22 billion in 2021 against Tk 4.11 billion a year ago, while the profit of First Security Islami Bank Ltd rose to Tk 6.90 billion from Tk 6.13 billion.

The operating profit of the National Credit and Commerce (NCC) Bank Ltd rose to Tk 7.17 billion in the past year from Tk 5.73 billion in the previous year while Union Bank Ltd’s reached Tk 3.75 billion from Tk 3.17 billion.

Premier Bank Ltd made an operating profit worth Tk 8.81 billion in 2021 against Tk 6.80 billion of the previous year while Social Islami Bank Ltd earned Tk 5.04 billion, up from Tk 4.60 billion in 2020.

The operating profit of National Bank Ltd came down to Tk 2.48 billion in the year from Tk 9.20 billion a year ago, while such profit of Modhumoti Bank Ltd fell to Tk 2.17 billion from Tk 2.78 billion.

NRB Bank Ltd made an operating profit of Tk 1.23 billion in the last year against Tk 1.07 billion a year ago.

Analyzing the unaudited data of 22 PCBs, the FE found at least five PCBs having crossed Tk 10-billion mark in pocketing operating profits in 2021.

Actually, the banks which have lower non-performing loans (NPLs) earned better than that of higher classified loan-holding banks.

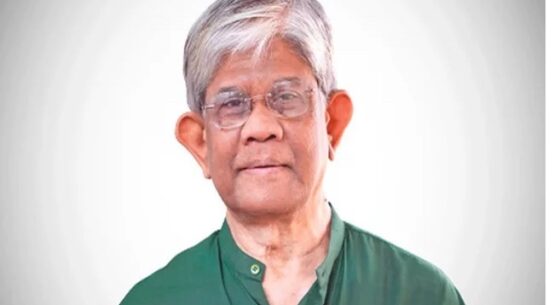

“Most of the PCBs earned more as operating profits in 2021 thanks to loan-repayment-policy relaxation by the central bank,” M Kamal Hossain, managing director (MD) and chief executive officer (CEO) of Southeast Bank Limited, said while replying to a query.

The Bangladesh Bank (BB) last Thursday relaxed further the loan-repayment policy for all the sectors to expedite Bangladesh’s economic recovery from the fallout of Covid-19 pandemic.

Under the latest relaxations, the borrowers would get a fresh chance to remain unclassified if they repaid minimum 15 per cent instead of previously-set 25 per cent of the total outstanding amount of loans for the whole calendar year by December 31, 2021.

As per the relaxed stance, the banks have been allowed to transfer interest earnings from such loans into their income accounts.

The senior banker also said implementation of the stimulus packages had also helped increase the operating profits of banks.

“The banks may face challenges in 2022 if the amount of NPLs increases further,” Mr Hossain predicts.

A senior executive of a leading PCB said some banks had been able to increase their amounts of operating profits following higher earnings from treasury operations.

The operating profit, however, does not indicate the real financial health of a bank since the lenders have to make room for provisioning against the loans, particularly classified ones, and taxes that have to be paid to the government from the profits.

Operating profits of the banks and non-banking financial institutions are a major source of income tax of the National Board of Revenue (NBR).

As such, the aggregate operating profit of the PCBs has an impact on the revenue collection in the form of direct taxes collected by the revenue board