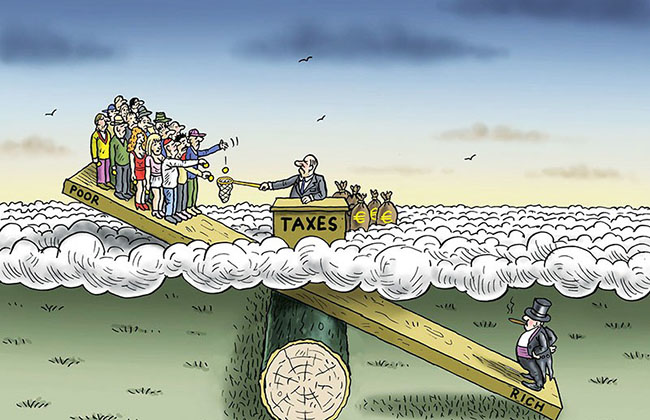

Despite taking VAT registration, around 22 percent of companies are not submitting their VAT returns. A large number of individuals are also remaining out of the tax network despite having taxable income. A total of 26 lakh people or 52.41 percent of the taxpayers did not submit their income tax returns in the last fiscal year. Of the 50 lakh Taxpayers Identification Number (TIN) holders, some 24 lakh submitted their income tax returns during last fiscal year. As a result, the National Board of Revenue is missing a large amount of revenue.

Though the companies are taking VAT for products or services from customers they are not submitting money to the government exchequer.The visiting IMF officials have advised the NBR to increase revenue collection in different forms.Economists and sector insiders have repeatedly suggested reforming the country’s revenue sector in a way that the tax ratio in the GDP would grow as per the volume of the economy.

In South Asia Bangladesh is the lowest tax-GDP ratio. A 2016 World Bank report said that the South Asian tax GDP ratio is 19.1 percent in Nepal, 16 percent in Bhutan, 12 percent in India, 9.9 percent in Afghanistan, 9.1 percent in the Maldive while in Bangladesh it is 8.8 percent. In 2017 Bangladesh’s position in tax GDP ratio slid to 7.6.

While official data portrays the burgeoning growth of Bangladesh’s economy, tax collection shows an almost opposite trend.The tax collection as a percentage of GDP has been stuck at around 7.6 percent in 2017, the lowest in South Asia and one of the lowest in the world. This prompts economists to question the disconnect since revenue receipts should increase in line with the expansion of the economy.

Dr Muhammad Abdul Mazid, former NBR chairman, told UNB that large companies might be avoiding VAT through different ways that the NBR cannot detect owing to a lack of capacity.He suggested enhancing the capacity of revenue officials, along with ensuring good governance in the revenue sector so that people encourage paying taxes in a hassle-free environment.

Dr Ahsan H Mansur, executive director at Policy Research Institute (PRI), said businesses could not fully make a turnaround from the pandemic-induced losses in FY2022 because of an economic slowdown to some extent, which led to lower growth in VAT collection from large companies.

Commenting on the poor collection from the banking sector, he said banks are now going through a bad patch with a slump in profitability. Mansur also suggested reforming the total VAT and tax sector to grow the revenue collection from domestic sources, in line with global standards, he said. “This shows a big mismatch,” said Selim Raihan, executive director of the South Asian Network on Economic Modeling. “It shows that there is no relation between GDP growth and revenue collection although the tax-to-GDP ratio increases in other countries because of the growth of the economy. In the case of Bangladesh, it is a puzzle,” he added.

According to NBR, there are 3.72 lakh companies that have taken VAT registration. Although among them 2.90 companies or 78.21 percent file VAT returns regularly. However, still, around 22 percent of companies do not submit VAT returns, according to official sources at the VAT Division of the NBR. A senior official of the NBR’s VAT Division told UNB that 3.72 lakh businesses have registered VAT till August this year. Among them, 2.43 lakh or 83.66 percent have filed returns in online platform.

As per the VAT Act, companies which have annual turnover below Tk50 lakh do not need VAT registration.