High levels of hunger will continue for another 136 years in many developing countries, according to a new report assessing global hunger. The report, the 2024 Global Hunger Index (GHI), paints a grim picture, predicting that global hunger levels will remain high for another century. If more progress is not made

Tag: developing countries

Exchange rate movements due to interest rates, speculation, not fundamentals

Currency values and foreign exchange rates change for many reasons, largely following market perceptions, regardless of fundamentals. Market speculation has worsened volatility, instability and fragility in most economies, especially of small, open, developing countries. US Fed pushing up interest rates For no analytical rhyme or reason, US Federal Reserve Bank (Fed) chairman

Developing countries need monetary financing

Developing countries have long been told to avoid borrowing from central banks (CBs) to finance government spending. Many have even legislated against CB financing of fiscal expenditure. Central bank fiscal financing Such laws are supposedly needed to curb inflation – below 5%, if not 2% – to accelerate growth. These arrangements have

1980s’ Redux? New context, Old Threats

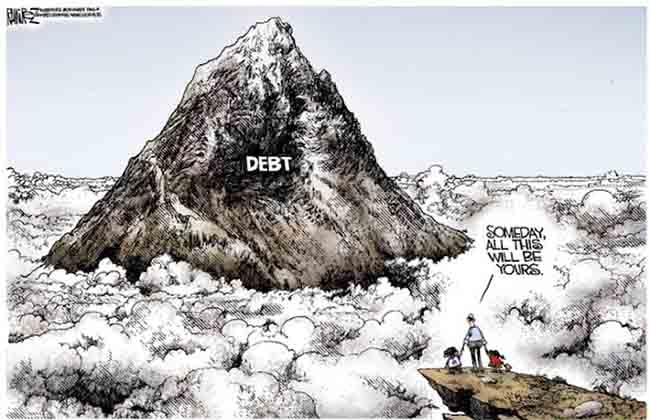

As rich countries raise interest rates in double-edged efforts to address inflation, developing countries are struggling to cope with slowdowns, inflation, higher interest rates and other costs, plus growing debt distress. Rich countries’ interest rate hikes have triggered capital outflows, currency depreciations and higher debt servicing costs. Developing country woes have